3 Credit Unions You Can Join Online, From Anywhere

Jan 25, 2024 By Triston Martin

Credit unions are owned by their members, unlike traditional banks. The tight-knit system intended in credit unions makes them have restrictions over who can join based on their location. Employees of the same company could rally together and start a credit union, which provides them with financial services such as loans, checking, and saving accounts.

Credit unions also differ from traditional banks because the former do not invest their money; they are nonprofit entities. They can therefore provide their members with lower loan interest rates and higher earning rates for savings. Credit unions in the US are insured by the National Credit Union Administration (NCUA) and not the FDIC.

Most credit unions have not offered open membership in the past. However, with changing times, they have found a way to retain their ‘closed’ system while still opening up membership to the general public. For instance, in most credit unions, members must maintain savings accounts.

Is it possible to join a credit union online?

Yes, it is absolutely possible. Nowadays, credit unions are flexible and allow individuals to join them from anywhere. However, this does not apply to all credit unions. While some will limit eligibility in terms of location, others will want you to physically present yourself to the credit union for physical physical verification.

Criteria to join credit unions online

You must meet certain criteria to join credit unions physically as well as online, such as the following:

- The industry and company you work for

- Where do you live or/and work

- Memberships

- Religion

- Family who may be members of the credit union

Once approved, you may be required to donate to the credit union’s foundation of choice.

You will also be required to provide the following personal details:

- Social Security Number

- Your physical address

- Driver’s license or passport

Credit unions you can join online

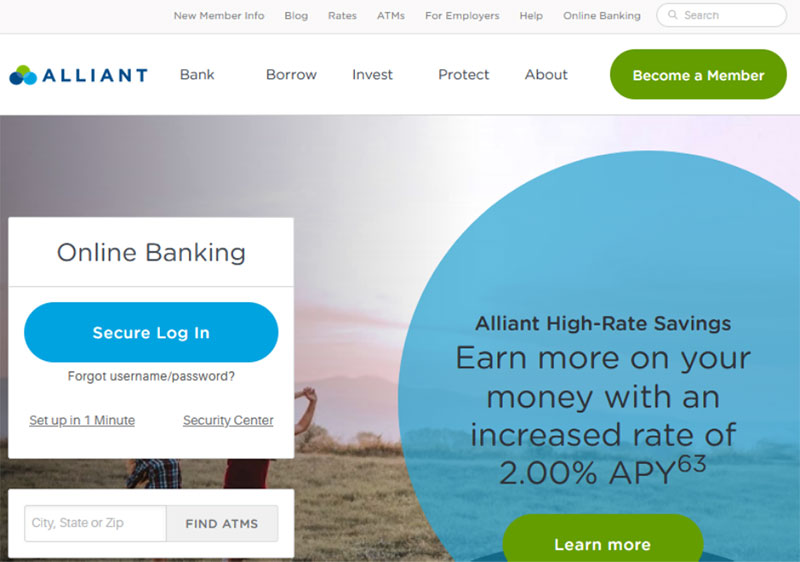

Alliant Credit Union

With its headquarters in Chicago, Illinois, founded in 1935, Alliant Credit Union began as United Airlines Employees’ Credit Union. Alliant does not have branches, so most members access services via the mobile app, website, or phone.

Eligibility

It serves employees, family members, retirees, and members of the Foster Care to Success organization (or you can pay $5 to join). Its core operations are for individuals around the O’Hare International Airport or in any qualifying Chicago area.

Applying for membership online gets you the following:

- No minimum balance or monthly service fees on your checking account.

- Dividends (interest on savings) are paid monthly.

- High-yield savings account with 2% APY.

- Alliant pays the $5 minimum deposit for your savings account.

- Loan services include auto, home, credit cards, personal, trust, and custodial loans.

- A sturdy online presence. It has a rating of 4.7 out of 5 stars on the App Store. The app has a messenger where you can communicate your inquiries to the responsible party. You can also plan your finances and create budgets using the app.

- Over 80,000 ATM locations.

- Liberty to open traditional Individual Retirement Accounts (IRAs).

Blue Federal Credit Union

Its headquarters are in Wyoming. The eligibility for members intending to join Blue Federal Credit Union is that you must live or work around the Western US. It offers an array of financial products, which it aptly calls Blue Solutions.

Eligibility

You have to donate $5 to the Blue Foundation if you don’t already live in Colorado or Wyoming. You must also open the Blue Federal Credit Union Membership Share Savings Account, where you must deposit $5.

You can also join if the Francis Warren Air Force Base employs you or if you are an active or retired member of the US Armed Forces.

For example, the Blue Extreme Checking Account does not charge monthly service fees and has no minimum initial deposit. There is the added benefit of 24/7 customer service that’s always live for online customers.

Opening an account with Blue gets you the following:

- Access to over 30,000 ATMs.

- Eligibility to join one of three rewards tiers: silver, gold, and sapphire. Each tier above offers higher benefits. You earn points for transacting with the union, such as taking loans and opening accounts.

- An online customer service that is 24/7 every day of the week, except weekends.

- A mobile app with every product Blue offers at the tap of a button.

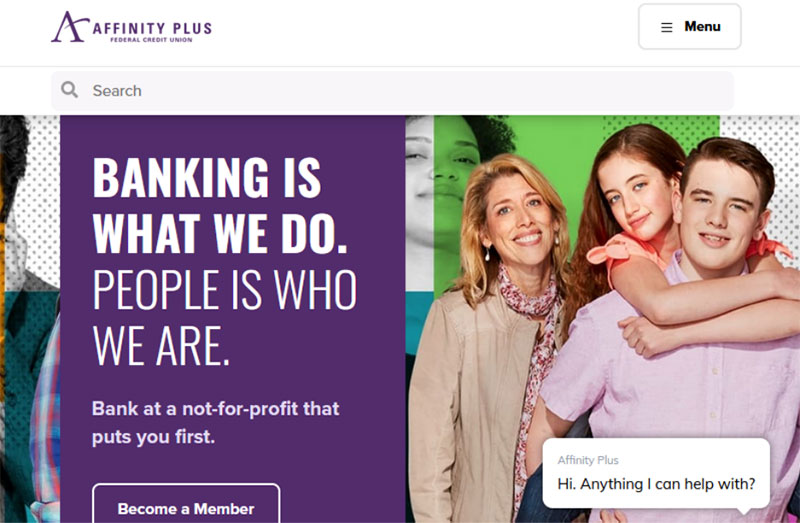

Affinity Plus Federal Credit Union

Affinity Plus Federal Credit Union’s website provides a seamless online banking experience on any device, whether a laptop or a phone. The benefits of banking online using this Affinity Plus include the following:

- You can make money transfers.

- You can check your balances online.

- You can download statements of your transactions.

- You can pay bills online and schedule payments.

- You earn MyPlus Reward points.

- Your credit score is visible, accessible, and in real-time.

- You can easily apply for loans online.

Affinity Plus Federal Credit Union offers 3.14% APR on auto loans, 3.50% APY on their SmartStart savings account, and 11.60% APR on credit cards.

Credit union members can access Affinity Members Alliance Insurance, an affiliate that provides diverse insurance coverage. Some of these include auto, health, home, and other forms of insurance coverage.

Affinity Plus has a dedicated page that caters to all matters dealing with online banking. An interactive bot is available any time and any day for your inquiries and feedback.

Like other credit unions, banking at a nonprofit ensures members get higher interests when they save and lower interests when they take out loans. Affinity Plus also aims to improve its members’ socioeconomic statuses.

Eligibility

One needs to donate $25 to the Affinity Plus Foundation to join. They will also be required to open a savings account. You may also be eligible if you live or work in and around Minnesota.

We have outlined three credit unions you can register for and apply for membership online, meaning you can do so from anywhere in the world. Our selection comprises credit unions with a good track record and years of experience providing financial services to their members.